Working While on a Student Visa: Australian Rules and Regulations

FACT-CHECKED ✅

International students on an Australian student visa can work part-time during their studies and full-time during term breaks, offering vital support for living expenses and professional development. A student visa (subclass 500) generally limits work to 48 hours per fortnight during term time but lifts this cap during official study breaks. Various industries (from hospitality to retail) welcome student employees, and the Fair Work Ombudsman safeguards their rights. Breaching work conditions can jeopardise your visa, so understanding regulations, tax obligations, and workplace protections is crucial. This guide unpacks the rules, your rights, and practical tips for navigating work in Australia seamlessly.

|

| International students on an Australian student visa can work part-time during their studies and full-time during term breaks. (📷:scherlund) |

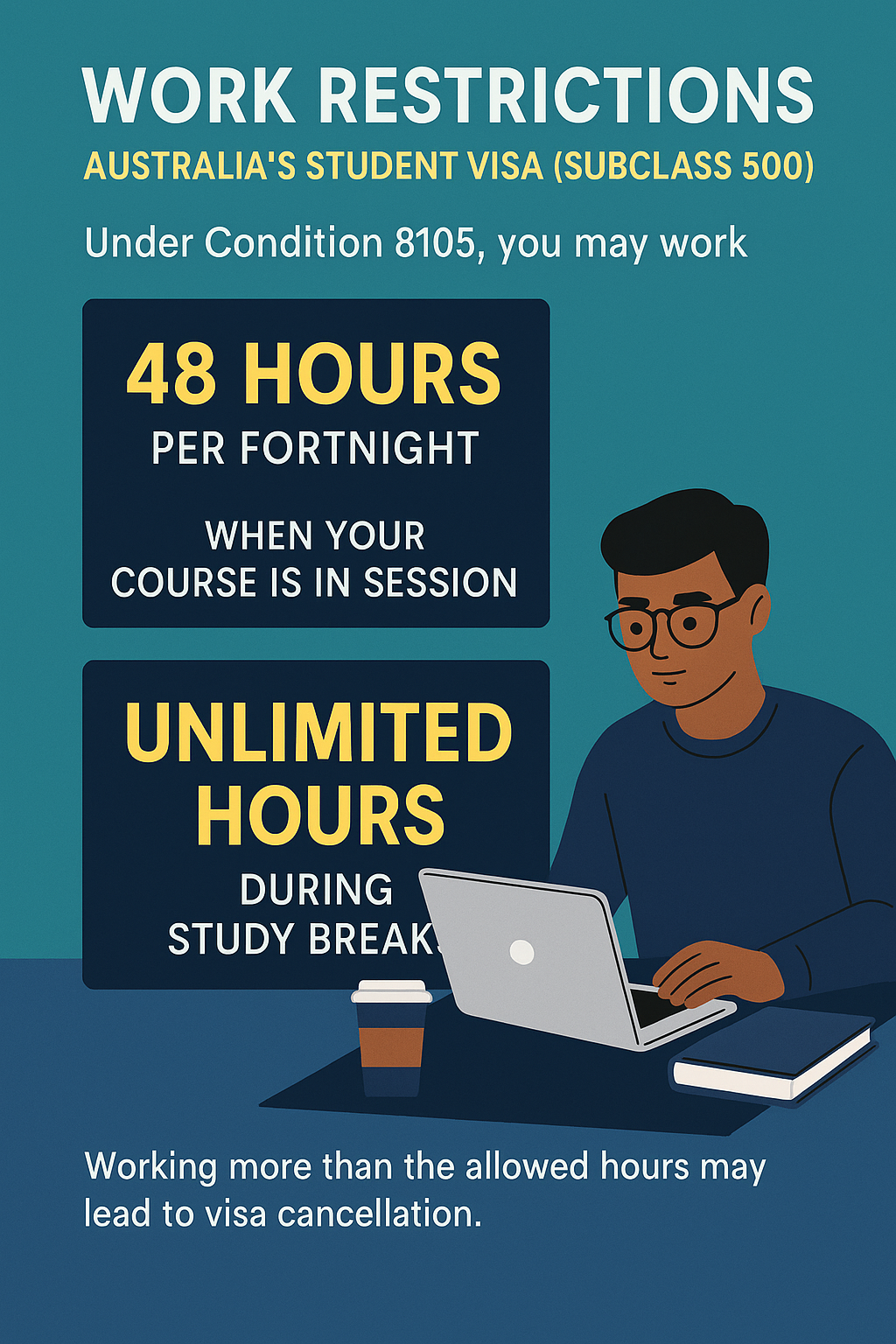

Australia’s Student visa (subclass 500) authorises international students to supplement their living costs through paid employment. Under Condition 8105, you may work up to 48 hours per fortnight (two-week period) when your course is in session. A fortnight is counted as the 14-day period beginning on a Monday; working six hours one week and 42 the next still counts as 48 hours in that fortnight. During recognised study breaks (such as semester holidays) you can work unlimited hours, allowing you to earn more when classes are not running.

Violating these work-hour restrictions can lead to visa cancellation or refusal of future visa applications. Therefore, maintaining accurate records of your work hours and understanding your course timetable is vital to avoid inadvertent breaches.

Types of Work and Sector Opportunities

International students are free to work in most industries, provided they do not occupy jobs specifically restricted to citizens or permanent residents (e.g., federal public service roles). Common sectors employing students include hospitality, retail, cleaning, and administrative support. These roles often offer casual or part-time hours that fit around study schedules.

|

| (📷:empowervmedia) |

Some students find internships or unpaid volunteering beneficial for gaining relevant experience in their field of study. Volunteering does not count towards the 48-hour limit and can enhance your resume, network, and cultural immersion. Additionally, after completing studies, the Temporary Graduate visa (subclass 485) permits unrestricted work, allowing you to transition smoothly from student roles to professional careers.

Tax, Superannuation, and Pay Rates

As an employee in Australia, you must comply with tax and superannuation regulations. If you earn over the tax-free threshold (AUD 18,200 per year), you are required to pay income tax. Your employer will ask you to complete a Tax File Number (TFN) declaration; providing your TFN ensures you are taxed at the correct rate.

Superannuation (retirement contributions) also applies to casual and part-time workers. Employers must pay an additional 11% of your ordinary earnings into a superannuation fund, which you can access upon leaving Australia if you meet certain criteria. Understanding these deductions in your payslips is crucial to budgeting and planning for post-study finances.

Workplace Rights and Protections

International students working in Australia enjoy the same workplace rights as local employees. The Fair Work Ombudsman oversees compliance with the Fair Work Act 2009, ensuring minimum wage, safe working conditions, and anti-discrimination laws are upheld. If you experience underpayment, harassment, or unsafe conditions, the Ombudsman can investigate and enforce penalties against employers.

|

| The Fair Work Ombudsman ensures minimum wage, safe working conditions, and anti-discrimination laws are upheld. (📷:apanetwork) |

Knowing your award or enterprise agreement is key: these documents specify minimum pay rates, penalty rates (e.g., weekends, public holidays), and leave entitlements. Always ask your employer which award covers your industry, and consult the Fair Work website or student support services if you’re unsure.

Visa Compliance and Monitoring

Your visa conditions are monitored through Visa Entitlement Verification Online (VEVO). Employers can check your work rights, and border authorities may audit work records. You must maintain accurate payslips, employment contracts, and records of hours worked. Your education provider also reports enrolment status to the Department of Home Affairs; poor academic attendance or course withdrawal can nullify your work entitlement.

If you need to work more than 48 hours per fortnight during term time for compelling reasons (such as financial hardship) you can apply for permission under Temporary Graduate visa provisions or submit a request to the Department of Home Affairs. However, approvals are rare, and it’s better to plan your finances within the standard limits.

Balancing Work and Study

Juggling employment and academic commitments requires careful time management. Too much work can impair your grades and jeopardise your course progress. Many universities offer workshops on balancing work and study, stress management, and financial planning (taking advantage of these resources can help you find an equilibrium.

Engaging with industry-related work, such as internships tied to your degree, often provides more relevant experience and flexible hours compared to purely casual roles. Networking through university career centres can lead to part-time positions that align with your field of study, enhancing both your academic understanding and future.

Transitioning Post-Study

Upon completing your studies, the subclass 485 Temporary Graduate visa allows you to work unrestricted hours, facilitating a transition into the Australian workforce. Depending on your qualification level and institution location, you may be eligible for a two- to four-year post-study work stream. Use this period to secure skilled employment, satisfy visa requirements for further residency pathways, and build local experience valued by Australian employers.

Practical Tips and Resources

To stay informed and compliant, regularly check the Study Australia and Department of Home Affairs websites for updates on work rights and visa conditions. The Fair Work Ombudsman’s international student fact sheet offer industry-specific guidance. Keep a simple work diary or use time-tracking apps to log hours accurately, and always confirm your total hours before accepting additional shifts. Finally, consult with your university’s international student office for tailored advice on balancing work with academic responsibilities.

|

| Various industries (from hospitality to retail) welcome student employees in Australia. (📷:bachelorstudies) |

By understanding the intricacies of your work entitlements, tax obligations, and workplace rights, you can use part-time employment not just to support your living expenses but also to enrich your Australian experience and career prospects. Remember, careful planning and compliance with regulations ensure that your work-study balance remains a valuable asset rather than a potential visa risk.

⭐⭐⭐

Comments

Post a Comment